Robust account reconciliation software

Save your accounting teams hundreds of unnecessary hours spent on manual tasks. With Redwood’s financial close automation solution, you can automate up to 80% of your reconciliations in the cloud or on-premises.

Why automate bank reconciliations?

Finance Automation by Redwood provides a foundation for greater control and insight into your cash flow.

-

Drive efficiency

Apply rules-based workflows and streamline exception handling for accounts that require remediation.

-

Eliminate manual steps

Reduce work across the financial close process by up to 70% with a top-down, risk-based approach to balance sheet certification.

-

Gain visibility

Obtain a complete overview of progress and quickly identify bottlenecks across all account reconciliation processes.

-

Build trust and confidence

Eliminate errors on financial statements and ensure reconciliations are thorough, accurate and on time for stakeholders.

-

Improve accuracy

Automate data collection, comparison and matching to dramatically reduce human error and gain greater confidence in your reporting.

-

Enhance fraud detection

Rely on automated monitoring and alerts to catch unusual patterns, unauthorized transactions or inconsistencies that might otherwise go unnoticed.

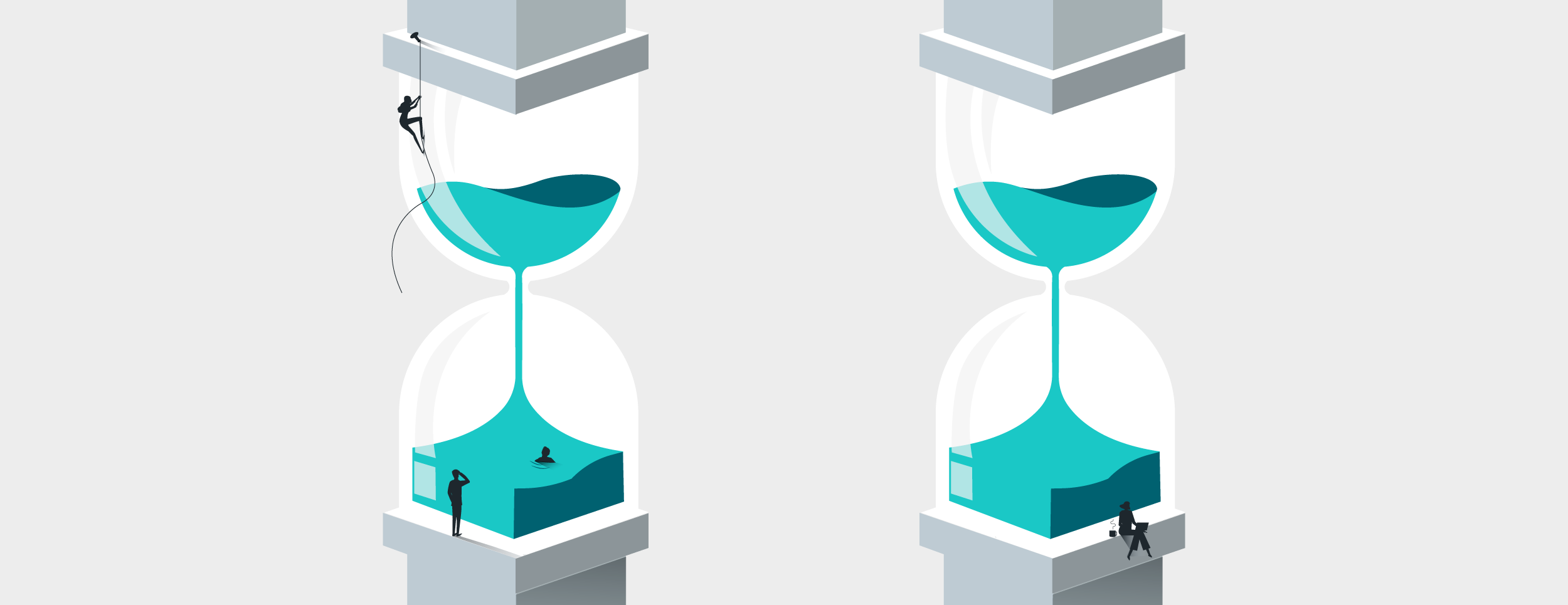

Reclaim time and focus on strategic work

Manual reconciliations are time-consuming and prone to delays. Finance Automation takes care of repetitive tasks so your finance team can stop chasing numbers and instead deliver insights and add value.

How automated account reconciliation works

Automation software intelligently handles the heavy lifting and frees your team for higher-value analysis.

- Data integration: Automatically pull financial data from your ERP, subledgers and other systems — no manual imports or formatting required.

- Transaction matching: Use intelligent rules to match high volumes of transactions quickly and accurately, flagging exceptions for review.

- Exception handling: Assign, track and resolve exceptions within a central workflow. Reduce delays and maintain accountability throughout the process.

- Compliance and audit trails: Maintain a full record of every action. Easily demonstrate compliance with internal controls and external regulations.

- Real-time reporting: Monitor reconciliation progress and KPIs through intuitive dashboards, ensuring visibility and control at every step.

Orchestrate your entire record-to-report (R2R) process

91% of finance leaders say R2R automation is critical, but only 58% have automated at least one key process.

Finance automation doesn’t stop at reconciliation or financial close management. Automate journal entries, manage intercompany eliminations and streamline provisions and reclassifications in a single platform.

Fuel informed decision-making

Make every step of the month-end close streamlined and scalable.

-

Accruals, provisions and reclassifications

Find Out MoreProduce more accurate financial statements.

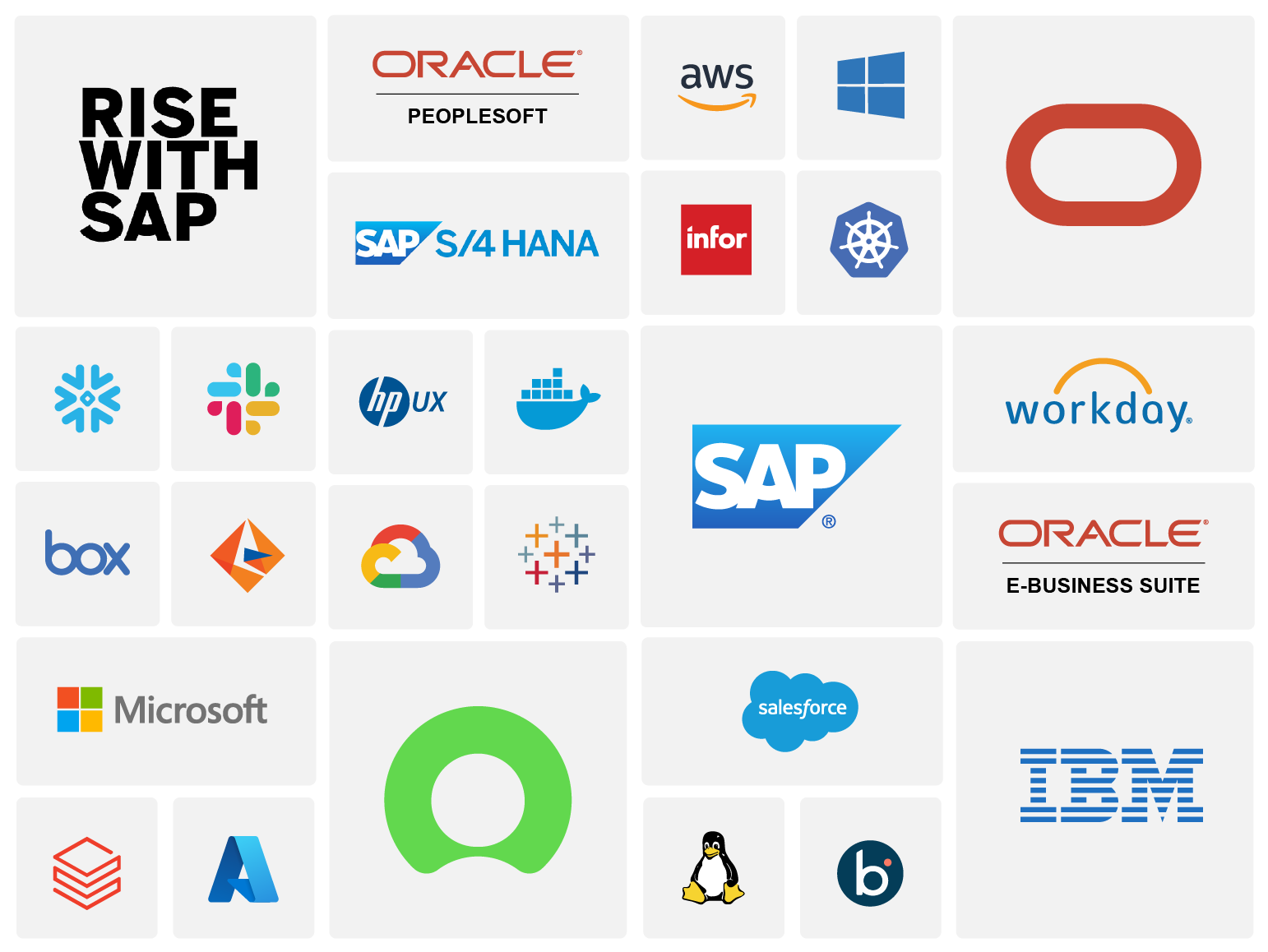

Integrate effortlessly with your ERP system

Finance Automation offers pre-built connectors to major ERP systems, enabling seamless integration and faster time-to-value without costly custom development.

Account reconciliation software FAQs

What is automated reconciliation software?

Automated account reconciliation software leverages advanced technology to automate the process of comparing and matching financial records from various data sources, such as the general ledger, sub-ledger and bank statements. This intelligent system efficiently identifies discrepancies and helps to streamline the entire account reconciliation process, significantly reducing reliance on manual processes and improving the accuracy and efficiency of the financial close.

Learn more about account and balance sheet reconciliation.

What are the benefits of automated account reconciliation software?

Implementing a robust reconciliation solution offers numerous benefits, including significantly faster financial close cycles, a substantial reduction in human errors often associated with Excel and manual tasks and improved audit-readiness with detailed audit trails. Furthermore, it provides finance teams and the CFO with enhanced visibility through dashboards and real-time insights into the health of the balance sheet, ultimately reducing the risk of fraud, errors or non-compliance with regulatory compliance standards.

Learn how automated account reconciliation software revolutionizes the financial close process.

What are the five steps to reconcile accounts?

- Collect data from your ERP and sub-ledgers: The initial step involves gathering all pertinent financial data from your core ERP systems and various sub-ledger systems to get a comprehensive view of all relevant transactions for accurate transaction matching. This may involve setting up integrations to various data sources to ensure a smooth flow of information into the account reconciliation software.

- Match transactions based on predefined rules: Once the data is collected, software solutions automatically match transactions between different data sets (e.g., general ledger and bank statements) based on configurable and predefined matching rules, significantly accelerating a process that is typically very time-consuming when performed manually. This intelligent transaction matching capability can handle high-volume data and complex matching scenarios.

- Investigate and resolve exceptions: Any unmatched items or discrepancies identified during the transaction matching phase are flagged as exceptions that require investigation and resolution by the accounting teams. The reconciliation solution often provides tools and workflows to efficiently manage these exceptions, track their status and facilitate the necessary journal entry adjustments.

- Approve reconciliations based on risk and materiality: After all identified exceptions are resolved, the completed reconciliations undergo an approval process based on predefined risk profiles and materiality thresholds, applying appropriate internal controls and oversight by relevant stakeholders. This step helps maintain the integrity of the financial statements and supports sound decision-making.

- Archive and audit the reconciliation trail: The final step involves securely archiving the completed reconciliations and maintaining a detailed audit trail of all activities, providing comprehensive documentation for auditors and ensuring data integrity and compliance with accounting processes and financial reporting requirements. Audit-ready documentation is crucial for demonstrating strong internal controls.

Learn how to prevent a bad audit and the four things that need to be addressed.

Turn down the stress

See more of what’s possible when you automate key processes.