Blog & Newsroom

Featured Blogs

-

-

Product knowledge

Product knowledgeThe observable enterprise: Navigating complexity in workload automation

-

-

Latest Content

-

Product knowledge

Product knowledgeWhy clarity, not coverage, defines modern observability

Reduce mean time to resolution (MTTR) and protect critical service-level agreements (SLAs) by shifting from simple monitoring to contextual observability. Transform fragmented operational data into actionable insights that help you anticipate risks and maintain uninterrupted mission-critical business processes.

-

Analyst research

Analyst researchThe automation talent shift: Building teams that thrive in the SOAP era

Modern automation has evolved from technical scripting to a strategic orchestrator of end-to-end business and IT processes. Empower your team to thrive in the SOAP era by shifting focus from task-based execution to service ownership and platform thinking.

-

Digital transformation

Digital transformationPayments modernization depends on orchestration — not just the core

Payments modernization depends on robust orchestration to eliminate the hidden risks of legacy back-end infrastructure. Discover how an orchestration control plane ensures real-time visibility and operational resilience, enabling you to scale new payment rails and AI-driven services with confidence

-

Finance automation

Finance automationThe reconciliation is done … or is it?

Learn how “completed” transactional reconciliations can mask unposted corrections, audit risk and close delays and why tying reconciliation directly to journal execution is the only way to achieve a truly controlled financial close.

-

Analyst research

Analyst researchWhy manufacturing automation has hit a plateau — and what will get it moving

7 in 10 manufacturers are stuck in mid-stage automation maturity. Explore more findings from Redwood Software’s latest research, and discover how to break through this ceiling and resolve common bottlenecks with event-driven orchestration.

-

AI (Artificial Intelligence)

AI (Artificial Intelligence)The AI and automation trends that will decide which enterprises hold up in 2026

Explore how AI and agentic systems will redefine enterprise resilience and automation strategy through 2026. See strategies for navigating the shift from task efficiency to orchestration, ensuring your AI initiatives deliver measurable value and reliable outcomes.

-

Analyst research

Analyst researchWhy most teams stop short of autonomous automation — and what it’s costing them

Finding and implementing automation solutions is no longer the challenge most enterprises face. Data from Redwood Software’s “Enterprise automation index 2026” makes this clear. Investment in automation continues to rise, and the majority view it as mission-critical. Yet, fewer than 6% of organizations have achieved autonomous automation in any core business process. That’s a substantial gap between intent and outcome. This points to a deeper issue: Many organizations have automated tasks and implemented point solutions,

-

Analyst research

Analyst researchSOAP platforms in the wild: Top 5 use cases

Service Orchestration and Automation Platforms (SOAP) unify fragmented silos to support the five critical Use Cases defined in the 2025 Gartner Critical Capabilities report. See how orchestrating IT workloads, data and DevOps pipelines empowers you to scale automation without increasing operational complexity.

-

Finance automation

Finance automationToo many tools, not enough automation: How finance became a graveyard of SaaS

Rethink your tech stack by identifying how fragmented point solutions create more problems than they solve. Discover how a platform-first automation strategy delivers real execution across finance instead of more tools to manage.

-

3-S

3-SYour success, our gratitude: Celebrating Redwood customer voices of 2025

Global enterprises using Redwood Software solutions have achieved results like 86% faster financial closes and saving 45,000 hours per year. See what some Redwood customers achieved in 2025 and how your organization can follow suit.

-

AI (Artificial Intelligence)

AI (Artificial Intelligence)Before agentic AI: The foundation every enterprise needs

Establishing a unified orchestration layer creates the secure foundation required to move from basic automation to advanced agentic AI. Learn how integrating governance and visibility today will empower your organization to scale intelligent operations safely and consistently.

-

Analyst research

Analyst researchThe business case for a modern SOAP: Where Critical Capabilities deliver real ROI

Build a credible business case for Service Orchestration and Automation Platforms (SOAP) using the 2025 Gartner® Critical Capabilities for SOAP report. Map five operational Use Cases directly to your P&L to drive resilience, agility and verifiable ROI.

-

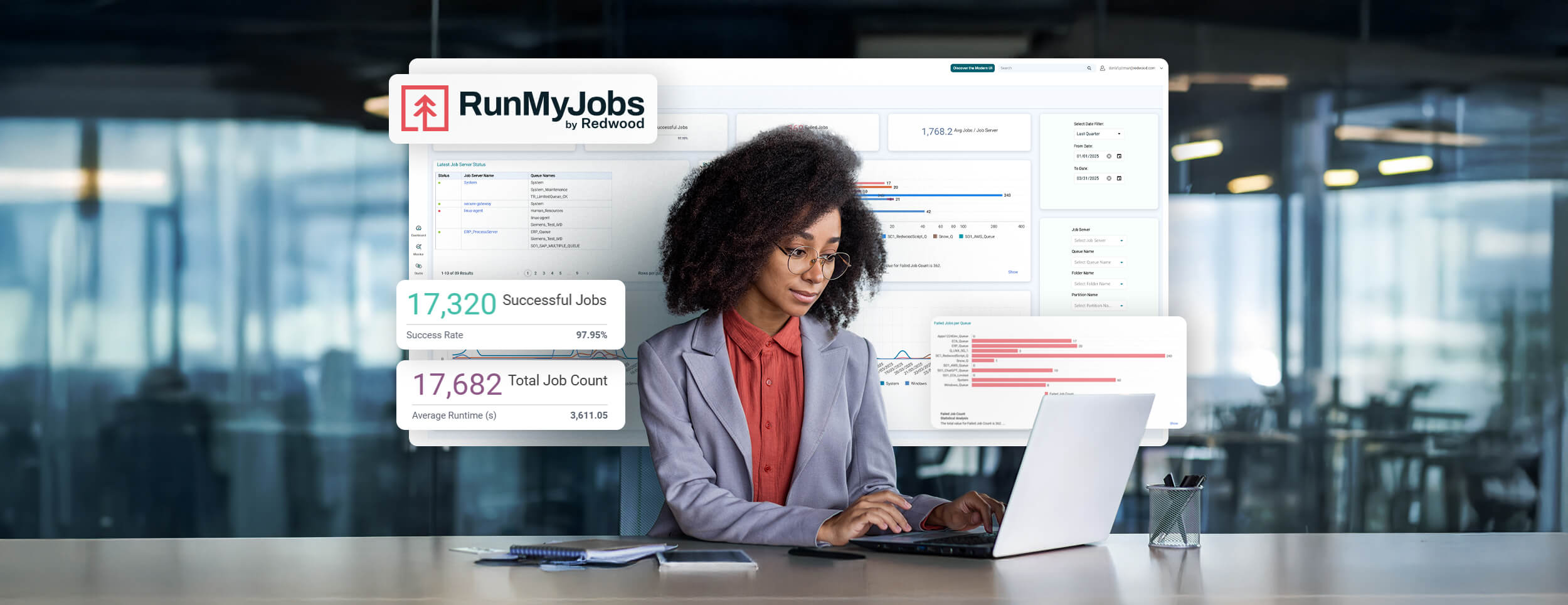

Product knowledge

Product knowledgeAI that delivers: Redwood RangerAI now available in RunMyJobs

Now available in RunMyJobs by Redwood version 2025.4, Redwood RangerAI empowers you to accelerate automation development and operations through AI-driven capabilities embedded directly into the platform. Generate scripts automatically, resolve errors instantly and scale your enterprise efficiently and securely with built-in governance.

-

Analyst research

Analyst researchSelf-driving automation: The leap from cruise control to true orchestration

Moving from isolated task automation to true enterprise orchestration requires a strategic evolution similar to the shift toward autonomous vehicles. Discover the five stages of maturity automation maturity and how to advance your operations toward intelligent, service-centric outcomes.

-

SAP

SAPSAP clean core and SAP Cloud ERP: Technical debt prevention with strategic orchestration

Enterprises adopting SAP Cloud ERP, formerly known as SAP S/4HANA Cloud, or modernizing through RISE with SAP share a common goal: moving faster without losing control.

-

Finance automation

Finance automationFrom checklists to automation: Why your close management is still manual

A close management system is only as good as the automation it enables. Get real-time visibility into your tasks.

-

Analyst research

Analyst researchBeyond the dot: A strategist’s guide to the 2025 Gartner® Magic Quadrant™ for SOAP

Look beyond a vendor's dot on the Gartner® Magic Quadrant™ for Service Orchestration and Automation Platforms to understand the true strategic value of the report. Learn how to interpret the Ability to Execute and Completeness of Vision axes to make smarter, long-term automation investments.

-

Analyst research

Analyst researchThe new rules of enterprise orchestration platforms

See why your legacy automation tools may struggle to manage modern hybrid cloud complexity and put business outcomes at risk. Learn the new rules defining modern orchestration platforms, from event-driven design to AI enablement.

-

Cloud

CloudWhat cloud modernization delivers — and why it’s the new standard

Understand why cloud modernization has shifted from simple migration to a new standard for business operations. Learn how aligning technology with core processes drives resilience, optimizes costs and creates a foundation for innovation.

-

AI (Artificial Intelligence)

AI (Artificial Intelligence)The next evolution of enterprise automation: Introducing Redwood RangerAI

Discover the next evolution of enterprise automation with Redwood RangerAI, a new suite of AI capabilities designed to combat modern operational friction. See how integrated assistants can help your teams learn faster, troubleshoot issues and scale smarter automation with greater confidence.

-

Cloud

CloudStill running automation on-prem? Cloud-first might be your next best move

Running workload automation on-prem can limit your ability to scale and adapt in today's hybrid and multi-cloud environments. Discover how a cloud-first strategy provides greater agility and resilience, helping you modernize operations without replacing your existing systems.

-

Product Pulse

Product Pulse9 signs it’s time to embrace SaaS workload automation

Learn how legacy workload automation can limit your ability to scale operations and innovate, even when daily processes seem to run smoothly. Discover nine clear signs your organization is ready to modernize and how a SaaS platform prepares you for future growth.

-

Finance automation

Finance automationThe unseen burden: Why your “automated” journal entry process is still manual

More than half of the typical month-end close depends on journal entries. But for most finance and accounting teams, “automation” still means entering numbers into Excel templates, attaching supporting documents and emailing approvals because manual work is hidden behind a polished user interface. It doesn’t have to be this way though. Finance Automation by Redwood eliminates manual journal entries entirely. It integrates with your ERP systems, orchestrates every step in the journal entry process and removes human intervention from data sourcing,

-

Digital transformation

Digital transformation40% of automation teams aren’t ready for AI — Here’s what they’re missing

Despite increased spending on automation, nearly 40% of teams admit they aren't ready to implement AI. Learn what the most mature organizations do to prepare their systems and processes for successful AI adoption.

Company News

Explore all Company News-

-

Company News

Company NewsAI ambitions outpace readiness in manufacturing

-