Blog & Newsroom

Featured Blogs

-

-

Product knowledge

Product knowledgeThe observable enterprise: Navigating complexity in workload automation

-

-

Latest Content

-

Digital transformation

Digital transformation40% of automation teams aren’t ready for AI — Here’s what they’re missing

Despite increased spending on automation, nearly 40% of teams admit they aren't ready to implement AI. Learn what the most mature organizations do to prepare their systems and processes for successful AI adoption.

-

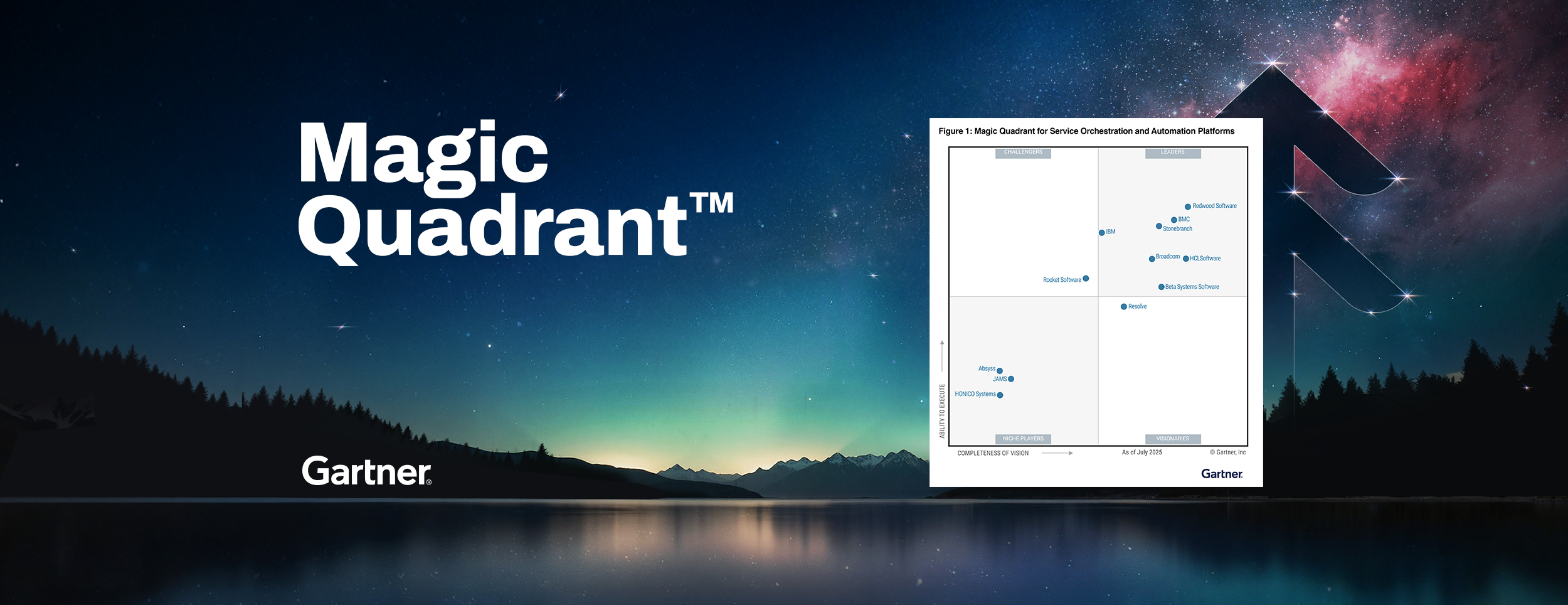

Analyst research

Analyst researchThe SOAP superpower: Why extensibility defines future-readiness for the enterprise

The Service Orchestration and Automation Platform (SOAP) market has expanded fast. In parallel with that growth, vendors have been vying for Leader positions in the Gartner® Magic Quadrant™ for SOAP since 2024. But with feature lists that sound nearly identical, it can be hard to tell which solutions truly enable end-to-end orchestration across complex enterprise environments. One way to tell is to look at integration. The best SOAPs aren’t just job schedulers with APIs.

-

Analyst research

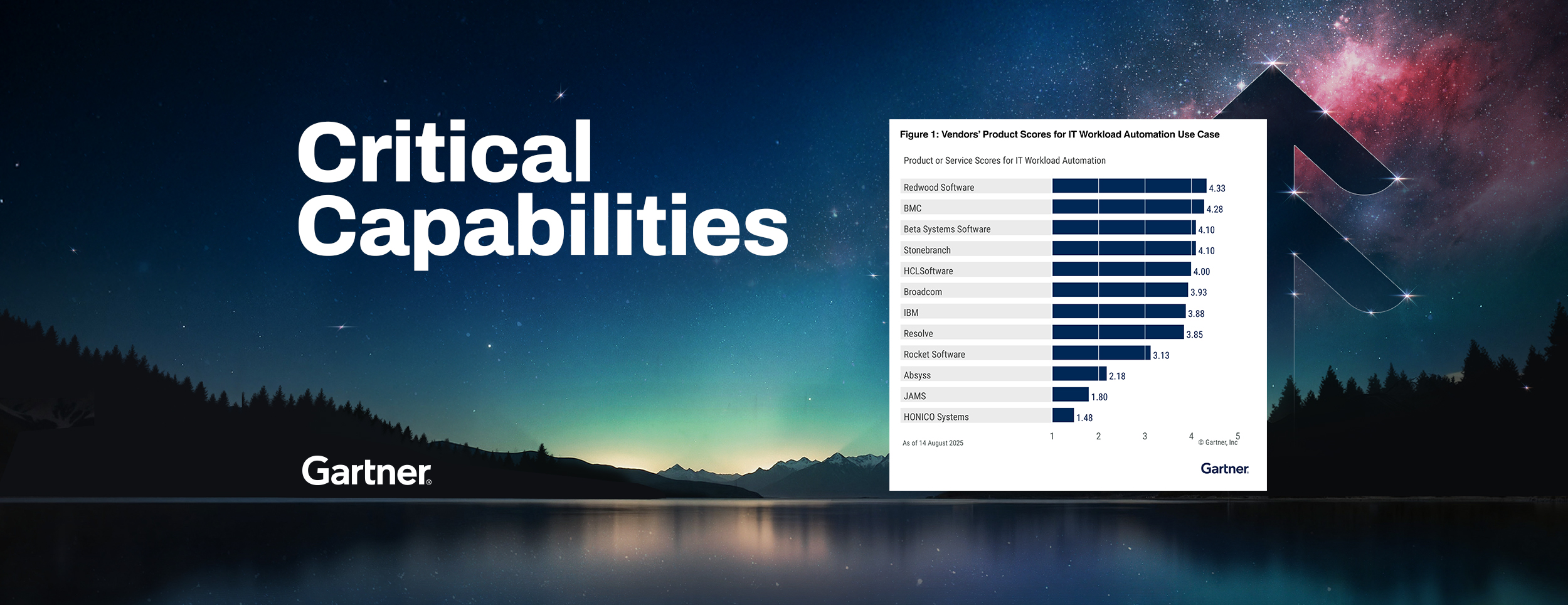

Analyst researchYour SOAP scorecard, inspired by Gartner® Critical Capabilities

Evaluate Service Orchestration and Automation Platforms (SOAPs) with a scorecard inspired by Gartner’s® Critical Capabilities for SOAPs report. Apply this practical framework to assess vendors against your specific business priorities and select the best solution for your needs.

-

Product Pulse

Product PulseGuide to choosing the right SOAP solution

Get a practical framework for selecting the right Service Orchestration and Automation Platform (SOAP) for your enterprise. Learn how to evaluate vendors on critical criteria like scalability, hybrid orchestration and AI-powered productivity to make a strategic decision.

-

SAP

SAPHow automation fabrics protect SAP forecasting and replenishment from failure

Forecasting and replenishment (F&R) looks straightforward to the customer but is a complex production with dozens of systems, processes and dependencies behind the scenes. Explore why even the best demand forecasts fail without orchestration and how an automation fabric can save your supply chain.

-

Finance automation

Finance automationThe illusion of progress: Why “automated” finance tools still run on human duct tape

Finance teams aren’t lacking in activity. From bookkeeping, journal entries and invoice processing to reconciliations and reporting, there’s always something in motion. Yet despite all the hustle, progress often feels out of reach. The real problem? Manual work hasn’t disappeared; it’s just been reshuffled into bottlenecks that delay more strategic work. In many cases, automation efforts have only shifted time-consuming accounting and finance tasks from one format to another. A spreadsheet becomes a shared dashboard. An email approval becomes a routed task.

-

Analyst research

Analyst research2025 Gartner® Critical Capabilities for SOAP: Redwood Software ranks first in all 5 Use Cases

Service orchestration and automation platforms empower heads of I&O to orchestrate end-to-end business services, expanding beyond traditional workload automation. This research can help heads of I&O choose the SOAP that best fits their needs.

-

Analyst research

Analyst researchRedwood Software named a Leader two years in a row: 2025 Gartner® Magic Quadrant™ for SOAP report

Discover why Redwood Software was named a Leader in the 2025 Gartner® Magic Quadrant™ for Service Orchestration and Automation Platforms (SOAP) for the second consecutive year. Gain insights into the evaluation criteria and see why Redwood was positioned furthest for Completeness of Vision and highest for Ability to Execute.

-

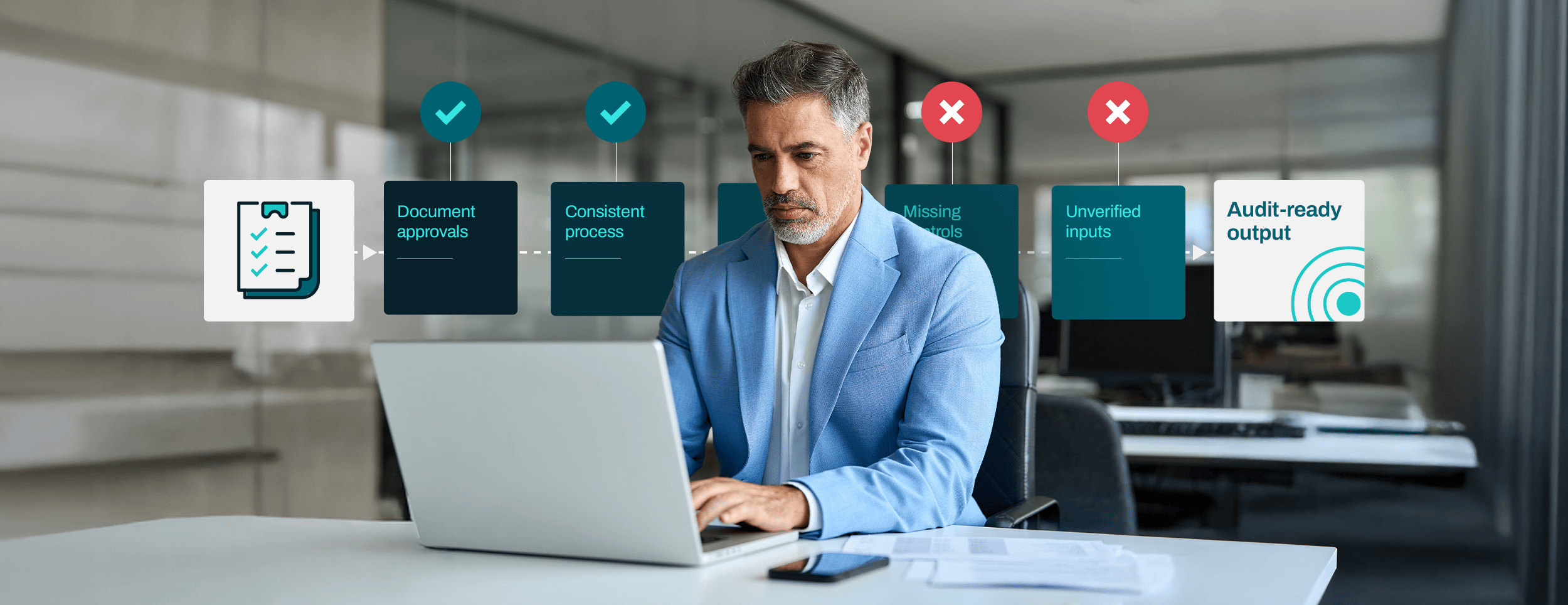

Finance automation

Finance automationManual, inconsistent, invisible: Why spreadsheets fail the test of reliable accounting

Discover how manual spreadsheet processes compromise accounting integrity and create significant operational risk. Finance automation establishes a secure, consistent and scalable foundation for modern financial reporting.

-

Analyst research

Analyst researchWhy is your automation failing? The surprising reason it’s not a tech problem

Find out why increased automation spending often fails to deliver ROI and the execution pitfalls that derail most strategies. Learn the four common traps of underperforming automation and what to do to transform your investment into a true growth lever.

-

Finance automation

Finance automationIs your R2R maturity truly moving from manual to autonomous?

Discover why many record-to-report (R2R) processes that seem automated are still burdened by hidden manual work and risk. Learn how to accurately measure your R2R automation maturity and shift from tactical fixes to strategic, end-to-end transformation.

-

Analyst research

Analyst research69% say automation is mission-critical — so why are only 10% prioritizing it?

While 69% of organizations call automation mission-critical, only 10% prioritize it at the executive level, creating a major gap between strategy and execution. Unpack why this disconnect isn't a funding issue but a failure of ownership and how top performers succeed by treating automation as a core operating capability aligned with business outcomes.

-

SAP

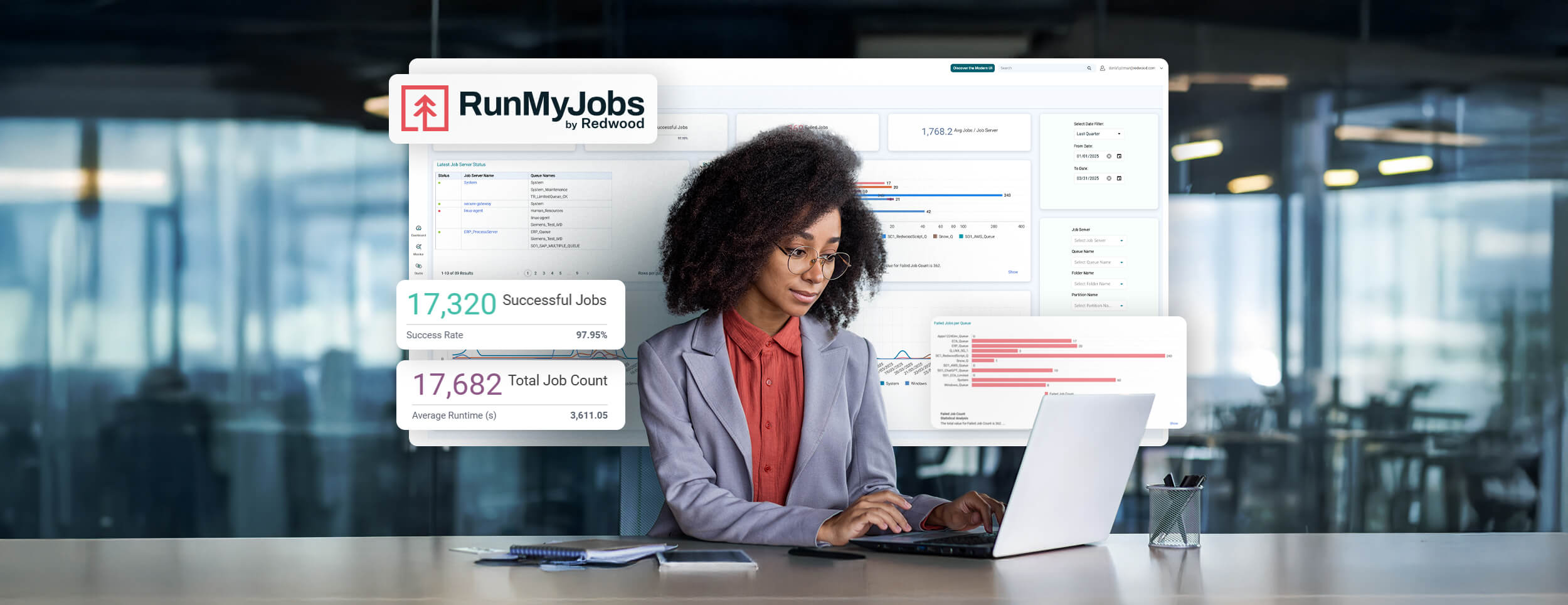

SAPSAP Endorsed App: Why it should matter to Redwood customers

RunMyJobs by Redwood isn’t just certified to work with SAP — it’s the only workload automation solution that’s an SAP Endorsed App, Premium certified. Learn why this highest level of trust and validation matters for future-proofing your automation and unlocking the full value of SAP and AI.

-

Digital transformation

Digital transformationAutomation at altitude: Orchestration becoming the runway for AI agility

Cloud, AI and data pipeline modernization efforts are accelerating, but without intelligent orchestration, complexity outpaces control. Explore why modern architecture is the foundation for enterprise agility in the AI era.

-

Finance automation

Finance automationWhy 39% of audits still fail — and what your accounting principles have to do with it

Nearly 40% of public company audits still fail — not because of fraud but because of lacking or outdated accounting principles. See how principles like objectivity and consistency break down in practice and how automation can restore the structure necessary for audit-readiness.

-

Product knowledge

Product knowledgeProactive problem management with Redwood Insights: Break the firefighting cycle

Redwood Insights empowers IT teams to move beyond reactive incident response and embrace proactive problem management through data-driven root-cause analysis. Learn how this built-in tool for RunMyJobs by Redwood helps prevent recurring failures, optimize performance and improve long-term service reliability.

-

SAP

SAPSAP AI readiness: Why “maybe” isn’t an option for job scheduling modernization

AI can’t deliver business value without clean, real-time data, and that depends on the effectiveness of the automation feeding that data to AI models. Explore why modernizing job scheduling is essential for enterprises running SAP and non-SAP systems to unlock the full potential of AI and future-proof operations.

-

Migration

MigrationBeyond lift-and-shift: Smart migration strategies for modern workload automation

Migrating your workload automation is a critical step in digital transformation, but it shouldn't be just a technical task. Learn how to use the migration as a strategic opportunity to drive business outcomes, improve operational efficiency and gain agility in the cloud.

-

Product Pulse

Product PulseSAP Sapphire 2025: Redwood customers ready for SAP AI transformation

Showcased at SAP Sapphire 2025, Redwood customers like Southwest Gas and RS Group exemplify how modernizing with fit-to-suite workload automation delivers critical operational efficiency, directly paving the way for AI. Their successes in automating complex processes, such as meter-to-cash and global business operations processing, establish the data foundations and agile systems essential for making enterprise AI an actionable reality.

-

Finance automation

Finance automationBeating the clock (and Parkinson’s Law): Why automation is key to a better month-end close

Is Parkinson's Law subtly sabotaging your month-end close, leading to wasted time and potential errors? Embracing automation provides a direct countermeasure and empowers your finance teams to move beyond simply meeting deadlines and achieve true efficiency and control.

-

SAP

SAPIntelligent data orchestration strategies for the hybrid finance landscape

Siloed data across SAP, cloud and legacy systems hinders reporting accuracy and compliance in financial institutions. See how an intelligent orchestration layer can connect and govern data flows for faster, safer and more auditable financial operations.

-

SAP

SAPBridging R&D and clinical operations with frictionless SAP data pipelines

Disconnected SAP data hinders the potential of AI in life sciences, delaying drug discovery and clinical operations. Intelligent data orchestration provides a solution by creating frictionless pipelines that connect R&D and clinical processes, enabling efficient data flow for advanced analytics and regulatory compliance.

-

Finance automation

Finance automationManual to magic: Agile automation for closing journal entries, account reconciliations and more

Revolutionize your financial close process by embracing agile automation for journal entries, account reconciliations and more key steps. Use this practical guide to transform tedious tasks into streamlined, efficient workflows through focused sprints and tangible wins.

-

Finance automation

Finance automationWhen the real work begins: Maximize finance automation ROI

Unlock the full potential of your recent digital transformation by strategically empowering your Finance team to move beyond routine tasks and become true business partners. Learn actionable strategies to redefine the function’s role and drive significant business value.