Why 39% of audits still fail — and what your accounting principles have to do with it

In 2024, 39% of public company audits inspected by the Public Company Accounting Oversight Board (PCAOB) had significant deficiencies. That may be down from 46% in 2023, but nearly four in ten audits failing is still a major red flag. These represent substantial enough issues to question the reliability of financial statements, the effectiveness of internal controls and the overall integrity of financial reporting.

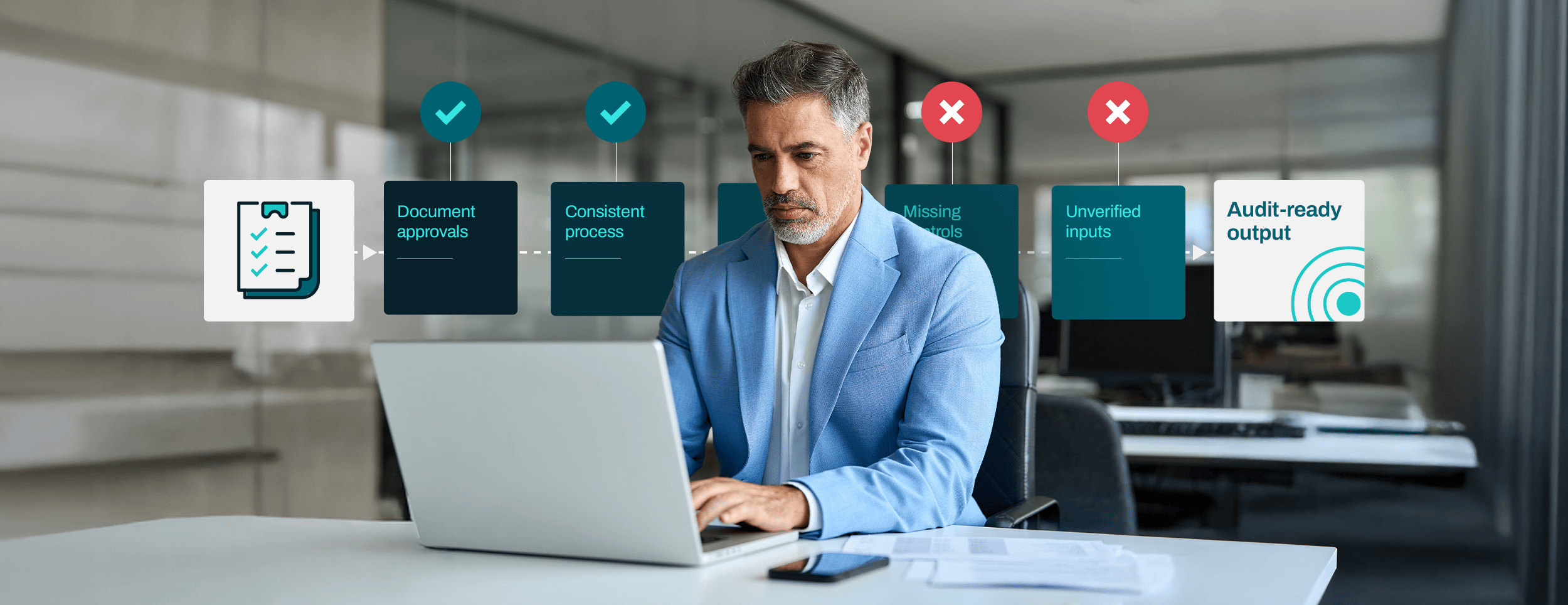

It’s tempting to point fingers at external auditors. But let’s not let internal accounting teams off the hook too easily. Audit firms assess the financial information you produce. The root cause of many audit failures isn’t fraud or negligence; it’s a combination of outdated processes, inconsistent procedures and systems that leave too much to chance. Two common culprits are a lack of objectivity and consistency.

These and other accounting principles should be built into your operations, but too often, they remain abstract — something your team relegates to a dusty handbook. Let’s look at how operational gaps undermine objectivity and consistency and how automation can reinforce them when they matter most.

Safeguarding professional judgment with structure

The PCAOB’s 2024 inspection report called out more than procedural issues. It highlighted a relatively widespread breakdown in professional judgment underpinning the audit process. Flawed evaluations, weak skepticism and insufficient support for critical assumptions, in particular.

These aren’t arising because internal auditors and accounting teams lack skill. In many cases, it’s because they’re forced to work with manual inputs, delayed data and undocumented workarounds that make objective judgment nearly impossible. When you’re reconciling accounts in Excel and building forecasts on stale numbers, subjectivity creeps in. Again, this isn’t out of carelessness, but because there’s not a reliable structure to keep judgment grounded.

Automation can’t replace human judgment, but it can reinforce it. With audit trails, workflow approvals and built-in control on data entry, automation operationalizes objectivity. It forces clarity and consistency in the places where human judgment is most vulnerable: under deadline pressure, with incomplete inputs or during handoffs between teams.

When your data is clean and your process is repeatable, your conclusions are clearer. That’s how objectivity holds.

The danger of doing things differently every time

Another principle worth revisiting in the audit conversation: consistency. Discrepancies and audit failures often trace back to inconsistent accounting practices:

- Recognizing revenue one way in Q1 and another way in Q4

- Applying different thresholds across business units

- Updating assumptions without documenting why

Inconsistent processes make it harder to detect fraud, forecast and audit. One of the biggest contributors? Tribal knowledge — when the “how” behind a task lives in someone’s head instead of in your systems. If one person handles intercompany eliminations a certain way and someone else does it differently, you get completely inconsistent (and unpredictable) outcomes.

Automation helps codify rules and apply them system-wide, remove reliance on institutional memory and ensure every action follows a known, repeatable process. You can still adapt when you need to, but automation forces that adaptation to be intentional rather than accidental.

Breaking the spreadsheet dependency

If 39% of audits are still failing, that’s not just an auditor problem. It’s a signal that objectivity and consistency aren’t being reinforced at the transactional level.

As regulators become more aggressive and public trust continues to erode, companies can’t afford to treat accounting principles like mission statements. There’s too much risk in relying on tools that weren’t built for control or consistency. Spreadsheets are flexible, but flexibility without structure is a liability.

Accounting principles must be enforceable through technology and process design.

If your tools and processes haven’t evolved to match the accounting standards you’re still expected to uphold, your audits will be at risk of failure. But going for just any shiny new tool won’t help. Automation will keep you true to the principles the profession is built upon, if you understand why new tech fails in finance and how to break that pattern.

About The Author

Caitlin Steel

Caitlin Steel is a passionate product leader with a mission to revolutionize the accounting profession. As VP of Product Management for Finance Automation at Redwood Software, she leverages her deep understanding of both the challenges and potential of finance to develop innovative automation solutions.

Caitlin's accounting journey began in the ‘80s, grappling with the first version of Excel. This experience ignited a lifelong quest to make accounting not just functional but inspiring. She brings a unique perspective, informed by her prior roles as a CFO and senior leader in product management at BlackLine, XaCTLY, OpenGov and other successful software companies. This experience has instilled in her a commitment to delivering high-impact products that empower teams.

When Caitlin steps away from the world of finance, she chases adventures. She's a champion for rescue dogs and enjoys lending a hand on her sister's ranch. This zest for new experiences fuels her creativity and brings fresh perspectives to her work.