Payments modernization built for scale, speed and control

Orchestrate and automate payment workflows across legacy systems, modern payment rails and hybrid cloud environments to achieve digital transformation goals faster.

Core capabilities of modern payment systems

Modern payment environments demand resilient execution across complex application, data and infrastructure technologies without increasing cost or operational risk — or limiting future payment functionality.

-

Hybrid cloud orchestration

Modern payment environments span on-premises systems, private clouds and public cloud services. Hybrid cloud orchestration keeps workflows consistent across environments without silos, duplicated tooling or constant re-architecture.

-

Data-centric payments workflow automation

Payments depend on tightly coordinated data flows, from initiation through settlement and reporting. Data-centric automation keeps pipelines sequenced, traceable and governed while supporting real-time and batch processing together.

-

Event-driven and API-orchestrated payments

Modern payment flows are triggered by APIs and events, not static schedules. Event-driven orchestration coordinates complex payment chains while handling retries and exceptions as volume and complexity grow.

-

Built-in governance, compliance and risk management

Governance and risk controls must scale with modern payment systems. Built-in auditability, access controls and service-level agreement (SLA) enforcement embed compliance directly into payment execution.

-

Enterprise-scale resilience and observability

High-volume payment operations require resilience by design. Enterprise-scale observability and automated recovery maintain uptime, reduce resolution times and limit operational firefighting as transaction volumes increase.

-

AI-powered automation lifecycle

AI adoption in payments depends on clean execution, reliable data and governed automation. An AI-powered lifecycle accelerates onboarding, development and troubleshooting while enabling intelligent optimization over time.

Payments modernization: A board-level priority

Payments are a critical lever for growth, risk management and customer experience. As transaction volumes rise and new payment rails emerge, executive teams are increasingly accountable for ensuring payment operations can scale reliably, meet regulatory expectations and adapt without driving up cost or complexity. Institutions that modernize successfully gain a competitive advantage by delivering faster payment experiences while maintaining strong financial and risk controls.

Without a modern foundation, payment operations are constrained by:

- Delayed settlement and limited funds visibility

- Manual reconciliation and high exception-handling costs

- Fragmented workflows across legacy and cloud systems

- Technical debt in the form of scripts and aging scheduling tools

- Limited visibility across real-time and batch payment flows

- Elevated operational and regulatory exposure

What successful payments modernization delivers

Payments modernization empowers financial institutions to support real-time rails, digital channels and increasing transaction volumes while maintaining control, resilience and compliance.

With the right foundation in place, your teams can modernize incrementally, launching new payment services, scaling operations and improving visibility without disrupting existing systems.

They’ll experience:

- Always-on payment operations across retail and commercial services

- Reliable real-time and instant payments at increasing transaction volumes

- Faster rollout of new payment rails and services without disruption

- Built-in governance, auditability and regulatory confidence

- End-to-end visibility and predictable scalability across payment environments

The impact of a modern orchestration control plane

RunMyJobs by Redwood is the leading orchestration platform for the autonomous enterprise, offering cloud-native architecture that can help evolve your traditional banking and financial services technology.

Unify, schedule, monitor and govern payments workflows at scale across hybrid cloud and data-centric environments.

RunMyJobs provides:

- AI assistance across the entire automation lifecycle for faster deployment and recovery

- Enterprise-grade SaaS reliability with proven 99.95% uptime

- Cloud-first, agentless architecture — no infrastructure to manage

- Event-driven and batch orchestration in a single platform

- Governed execution with full auditability and compliance controls

Powering payment operations with RunMyJobs

A single orchestration platform supports a wide range of payment workloads, from core integrations to emerging payment services.

-

Instant payment execution

Orchestrate real-time and instant payments with consistent execution, even as transaction volumes and customer expectations increase.

-

New service expansion

Introduce new payment rails and digital payment solutions alongside existing services without disrupting legacy infrastructure.

-

Essential integration

Connect cloud-native services, APIs and data platforms to core banking systems to support modern payment functionality.

-

Reliable processing

Support high-volume and bulk payment processing with SLA-backed reliability across domestic and global payments.

-

Operational visibility

Gain end-to-end visibility into reconciliations, exceptions and settlement workflows to improve financial controls and decision-making.

-

Future-proof standards

Manage ISO 20022 migration and messaging workflows to support global standards and new payment technologies.

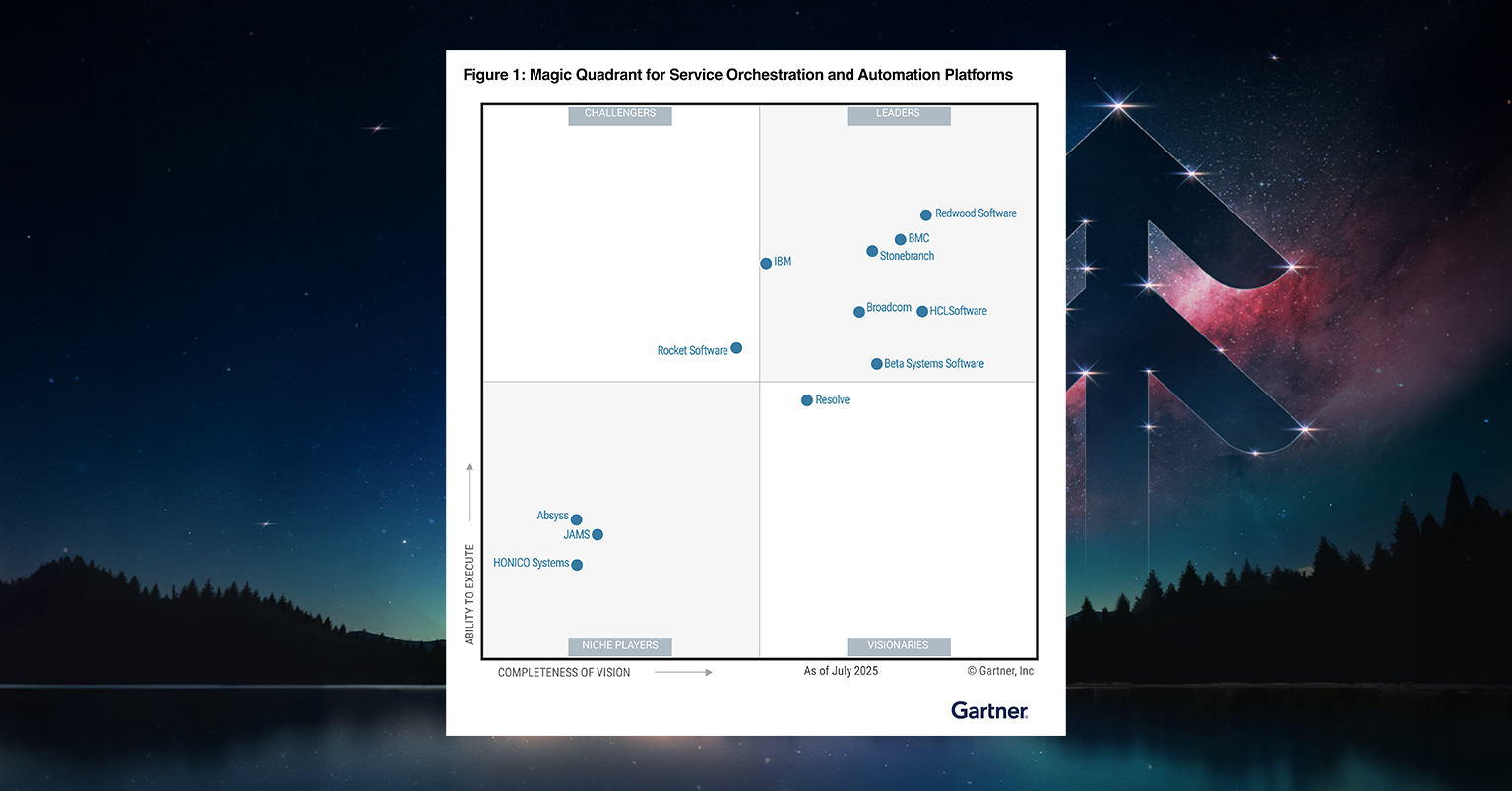

Gartner® 2025 Magic Quadrant™ for SOAP

Gartner named Redwood Software a Leader, positioned furthest in Completeness of Vision and highest for Ability to Execute, in its Magic Quadrant™ for Service Orchestration and Automation Platforms (SOAPs).

Click below to get your copy of the full analyst report.

How payments modernization aligns financial services teams

Payments modernization impacts technology, operations and business teams differently. Success depends on alignment across all three.

-

Technology and operations leadership

Maintaining stability and control means:

- Reducing operational risk across complex payment ecosystems

- Replacing legacy schedulers and scripts with a modern SaaS platform

- Shifting spend to innovation over maintenance

-

Architecture and engineering teams

Prioritizing consistency and reliability requires:

- Simplifying hybrid-cloud payments orchestration

- Standardizing workflows across APIs, data and infrastructure

- Improving reliability, compliance and scalability

-

Business and payments leaders

Focusing on speed and visibility is about:

- Accelerating settlement and improving cash visibility

- Reducing disputes and reconciliation costs

- Launching modern payment services with confidence that they will scale

Insights for your payments modernization strategy

Explore research, analyst insights and practical guidance to help you upgrade your automation strategy and payment capabilities.

Payments modernization FAQs

What is payment modernization?

Payment modernization is the process of updating payment systems, infrastructure and workflows so financial institutions can support real-time payments, digital payment experiences and growing transaction volumes without increasing operational risk. It typically involves moving away from rigid, legacy payment systems toward more flexible platforms that can support new payment rails, global standards like ISO 20022 and modern payment methods such as instant payments and digital wallets.

For banks and financial services providers, payments modernization is not just a technology upgrade. It is a strategic initiative focused on improving customer experience, operational efficiency and decision-making while meeting regulatory, security and scalability requirements. Modernizing payments enables institutions to launch new payment services faster, respond to customer demands and remain competitive in an increasingly digital payments ecosystem.

How are complex payment workflows coordinated across multiple systems?

Complex payment workflows are coordinated by orchestrating the sequence, dependencies and handoffs between systems involved in payment processing. This includes core banking platforms, payment rails, fraud detection services, data pipelines, reconciliation tools and external partners such as clearing networks or fintech providers.

In modern payment environments, workflows often span legacy systems, cloud-based services and real-time platforms. Effective coordination ensures that each step, such as authentication, routing, settlement and reconciliation, runs in the correct order, recovers automatically from failures and remains fully auditable. This level of orchestration is critical for maintaining uptime, reducing bottlenecks and ensuring consistent payment experiences across channels.

How are new payment rails introduced without impacting existing services?

New payment rails are introduced by running them in parallel with existing payment systems rather than replacing everything at once. This approach allows financial institutions to modernize payments incrementally while continuing to support traditional payment methods and customer workflows.

By isolating new payment services through standardized workflows and controlled rollout processes, institutions can test, validate and scale new rails, such as real-time or instant payment networks, without disrupting production operations. This reduces risk, protects customer experience and gives payments teams the flexibility to expand capabilities as volumes grow and regulations evolve.

How are data pipelines orchestrated in payment processing?

Data pipelines are integral to payment process outcomes requiring orchestration across systems in a reliable, traceable and compliant way. This includes transaction data ingestion, enrichment, fraud scoring, reconciliation, settlement reporting and analytics.

Modern payment environments must support both real-time and batch data processing while maintaining data observability and governance. Orchestrating these pipelines ensures that data moves in the correct sequence, dependencies are respected and exceptions are handled automatically to deliver payment service outcomes and meet service-level agreements (SLAs). This improves accuracy, speeds up settlement and provides the visibility financial institutions need for risk management, compliance and reporting.

How are payments orchestrated across hybrid cloud systems?

Payments are orchestrated across hybrid cloud systems by coordinating application and data pipeline workflows that span on-premises infrastructure, private cloud environments and public cloud services. Many financial institutions operate in hybrid environments due to regulatory requirements, legacy investments and the need for resilience.

Effective payments orchestration ensures consistent execution regardless of where workloads run. Payment workflows can trigger from APIs, events or schedules and then move seamlessly across environments without manual intervention. This approach improves scalability, supports cloud-based payment innovations and allows institutions to modernize payments without re-architecting their entire infrastructure.

How do real-time and batch payments work together?

Real-time and batch payments share common workflows, data pipelines and governance controls while operating on different timelines. Real-time payments focus on immediate execution and customer responsiveness, while batch payments handle high-volume processing such as settlements, reporting and reconciliation.

Modern payment systems are designed to support both models side by side. Orchestrating real-time and batch processes together ensures data consistency, end-to-end visibility and reliable handoffs between payment stages. This allows financial institutions to deliver instant payment experiences without losing the efficiency and cost advantages of batch processing.